Price Action Guide (Edition 7)

Original price was: $89.00.$79.00Current price is: $79.00.

RICE ACTION BIBLE – BO TURBO TRADER PDF (EDITION 7)

– MINDSET FOR CONSISTENT PROFITS

– PRACTICE

– WIN RATE

– DISCIPLINE

– MONEY MANAGEMENT

– EMOTIONS

DON’T MISS THE OPPORTUNITY TO GET THIS PRICE ACTION BIBLE (7 EDITION)

Description

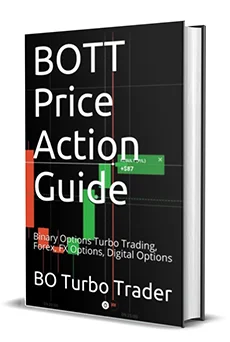

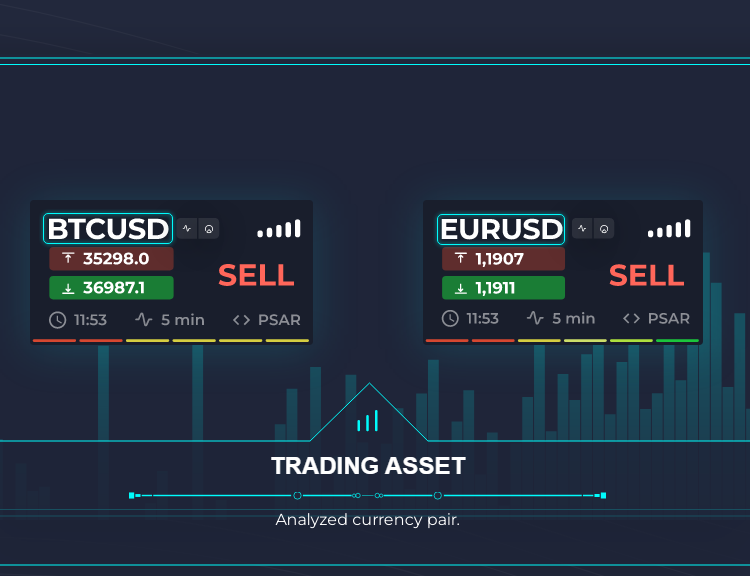

The ultimative Price Action guide (7 edition) for any kind of financial instrument (Binary Options, Forex, FX Options, Digital Options) any kind of time frame from 1 min over 5 min up to 15 min, 30 min and above and any kind of broker. This ebook is all you need, especially as a binary options turbo trader or Forex day trader to get profit out of the market, get out of debt, make yourself a living or help your friends and family and to achieve financial freedom.

Don’t miss the opportunity to get this ultimative Price Action guide (7 edition)

File Size: 12597 KB

Print Length: 118 pages

Publisher: BO Turbo Trader; 7 edition (October 24, 2018)

Publication Date: October 24, 2018

Content:

Mindset for consistent profits

– Practice

– Win Rate

– Discipline

– Money Management

– Emotions

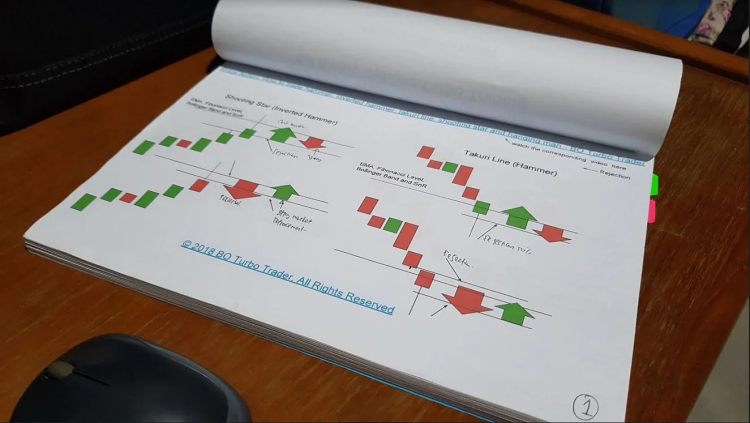

Candlestick Patterns

– Hammer, Inverted Hammer, Takuri Line, Shooting Star and Hanging man

– Dragonfly Doji, Gravestone Doji

– spinning top – long-legged doji, high wave and rickshaw man

– Pinbar – Pin Bar – Pinocchio bar or Kangaroo Tail

– Tweezer Top and Tweezer Bottom

– bearish harami, bullish harami and bullish harami cross and bearish harami cross

– three inside down, three inside up

– descending hawk and homing pigeon

– bearish meeting line – counterattack line and bullish meeting line

– bearish belt hold – black opening shaven head – black opening marubozu

– bullish belt hold – white opening shaven bottom – white opening marubozu

– bearish kicker signal – bullish kicker signal

– matching high and matching low

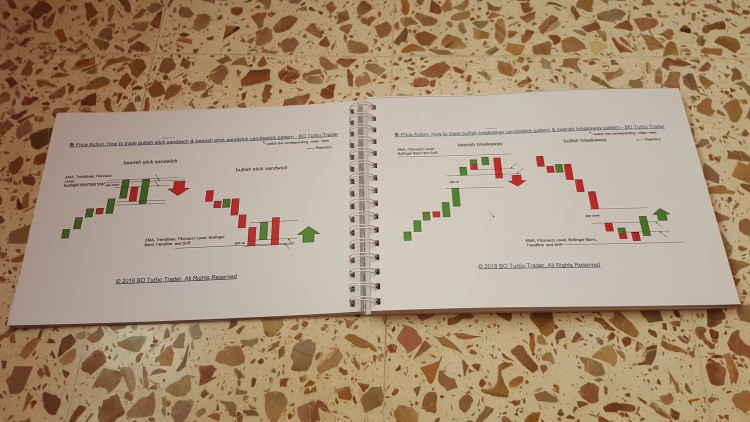

– bearish stick sandwich and bullish stick sandwich

– bearish breakaway and bullish breakaway

– ladder top and ladder bottom

– tower top and tower bottom

– three stars in the north and three stars in the south

– bearish sash pattern and bullish sash pattern

– engulfing candlestick pattern or the big shadow pattern

– (bearish) dark cloud cover and (bullish) piercing line

– Breakaway gap, exhaustion gab, continuation gap and common gaps

– rising window and falling window

– marubozu and big belt

– inside bar and mother bar

– evening star, morning star and evening doji star and morning doji star

– three white soldiers and three black crows

Chart Patterns

– Double Top – M Formation – Mammies and Double Bottom – W Formation – Wollahs

– J-Hook pattern and inverted J-Hook candlestick pattern

– bearish last kiss – bearish pullback and bullish last kiss and bullish breakout

– Head and Shoulders and inverted Head and Shoulders Pattern

– Trend Channel – uptrend and downtrend

– symmetrical triangle

– ascending triangle and descending triangle

– bullish flag and bearish flag

– bullish pennant and bearish pennant

– rising wedge and falling wedge

– Broadening Bottoms and Broadening Tops

– Rectangle Bottoms and Rectangle Tops

Concepts

– Candlestick Mathematics

– Rejection – market move

– weak snr and strong snr

– trending and ranging market

– minor and major trend

– adapting forex strategies to binary options turbo trading

– proper rejection – invalid rejection

– false breakouts – channel breakouts

– reversal and retracements

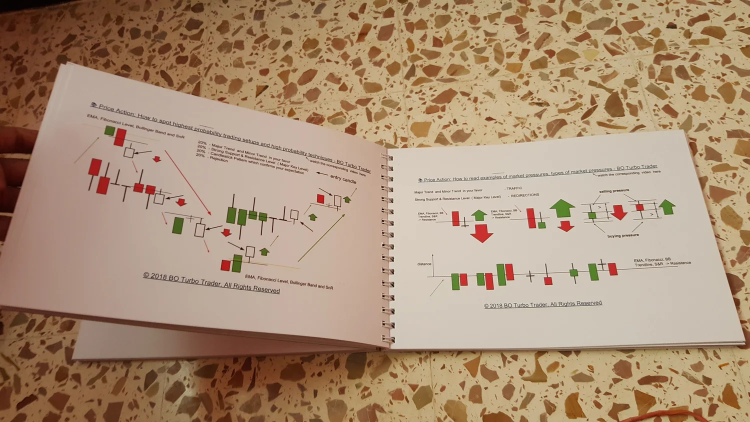

– highest probability trading setups

– high probability techniques

– market pressures and types of market pressures

– upper shadow and lower wick or tail

– advanced candlestick charting techniques

– overbought and oversold – oscilator – RSI CCI Stochastic Oscilator

– different market conditions and market conditions examples

– cycle of market emotions, psychology and dynamics

– trading setups without rejections as confirmation

– multiple time frame trading concept, system, methology and strategy

– candlestick momenting

– direction of candlestick momentum

– inside swing and outside swing

– support and resistance – minor snr and major snr

– false breakout, breakout strategy

– supply and demand, change of polarity – support <-> resistance

– support and resistance based on candlestick pattern

– elliott wave analysis and elliott wave principle

– bullish candlestick chart psychology – pressure reading

– bearish candlestick chart psychology – pressure reading

– reading candlestick charts and candlestick analysis

– predict next candle direction – next candlestick prediction

– analysis candlestick chart and running candlesticks

– identify entry points and how to find entry points

– predicting the direction of running candlestick

– market conditions to avoid using candlestick analysis

– best time to trade, best day of the week to trade

– everything about bollinger bands

– everything about moving averages

– Fibonacci Retracements

– Fibonacci Extensions and Projection

High probability trading setups

– BOTT Sure Shot 1 (EMA)

– BOTT Sure Shot 2 (EMA)

– BOTT Sure Shot 3 (EMA)

– BOTT Sure Shot 4 (EMA)

– BOTT Sure Shot 5 (Fibonacci)

– BOTT Sure Shot 6 (Fibonacci)

– BOTT Sure Shot 7 (Fibonacci)

– BOTT Sure Shot 8 (Fibonacci)

You must be logged in to post a review.

Reviews

There are no reviews yet.